This is the Canadian income tax guide for YouTubers earning income. We also have a U.S. income tax guide.

Disclosure: This is not official tax advice. Always perform your own research and consult with a CPA/tax expert.

We recommend Virtual Books, a Canadian accounting and tax provider specializing in influencers and creators.

Contents

Do YouTubers have to pay taxes?

Yes. Just like everyone else, YouTubers have to pay taxes on all income associated with being a YouTuber/social media influencer. Income attributable to a YouTube business may include Google AdSense earnings, free products received, and direct payments from companies for video sponsorships.

Are free products received considered income?

Yes. If you receive free products to promote on your YouTube channel or other social media channels, this can give rise to income. Even though you have not received any cash, you have still received an income inflow, and must declare the fair market value of the goods as income. The fair market value is often the price you would have had to pay for the products had you not received them for free.

Is being a YouTuber considered a business?

Yes. As a YouTuber, you are deemed to be carrying on a business in the eyes of the Canada Revenue Agency (CRA). Therefore, you must report all earnings associated with your YouTube business as gross business income. You are then entitled to various deductions to bring down your overall net income for business purposes.

Types of Business Entities

Sole Proprietorship

A sole proprietorship is an unincorporated business that is owned by one individual. It is the simplest kind of business structure.

Canada Revenue Agency

If you are a sole proprietor, you pay personal income tax on the net income generated by your business.

You may choose to register a business name or operate under your own name or both.

A common question that we get asked is “Are YouTubers sole proprietors?”. In most circumstances, the answer is yes, YouTubers are sole proprietors. By default, people who make money from YouTube will be considered a sole proprietor and will be required to report their YouTube income as business income.

A sole proprietorship is the most common form of business entity for independent YouTubers. As a sole proprietor, your YouTube income is reported on your personal income tax return (T1) under form T2125 “Statement of Business or Professional Activities”. You may simply use your name as the business name. The NAICS (North American Industry Classification System) code 519130 “Internet Publishing and Broadcasting and Web Search Portals” should serve as an appropriate code for a YouTuber.

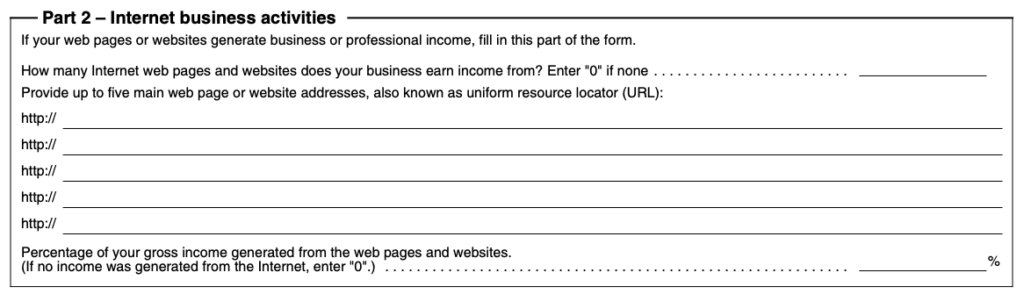

On form T2125, you must list all appropriate websites from which your income is derived. As a YouTuber, the most obvious will be YouTube.com, however, any additional income streams associated with this business must also be disclosed, which may include Patreon.com, Shopify.com, or Amazon.com, if these are platforms from which you derive additional income.

The next parts of the form require you to report your gross income received through your business. If you’re paid in USD, you must convert the USD amounts using the annual average exchange rate retrieved from the Bank of Canada. Additionally, any goods received through the course of your YouTube business also need to be declared as income at their fair market value, so don’t forget about that lipgloss kit you received in exchange for a brand shoutout on your channel or social media accounts.

As a business, you are entitled to deduct expenses that you may incur to earn income from your activities. For common business expenses as a YouTuber, please see the Common Business Expenses and Deductions section below. Depreciable property such as a building, furniture, or equipment used in the course of your business cannot be fully deducted in the year in which they are purchased. Instead, the cost of these properties will be deducted over the course of several years at a rate determined by the Canada Revenue Agency, known as a Capital Cost Allowance (CCA) rate. Typical CCA rate categories are listed under the Capital Cost Allowance section below.

Neo Financial: Our Recommendation

Open a Neo Money account and earn up to 225x more interest than at traditional banks (2.25% APY), all with no annual or monthly fees (FREE)! Neo Financial is a 100% digital banking service and it only takes 3 minutes to setup your account.

Apply for the Neo Card and receive a $25 welcome bonus while earning an average of 5%+ cashback at thousands of local and national partners and businesses. The Neo Card will allow you to keep your business expenses separate, all while earning instant cashback on purchases and no annual fees.

Neo Money is provided by Concentra Bank.

Card issued by ATB Financial pursuant to license by Mastercard International Inc.

Deadlines

April 30 – any balances owing due to CRA

June 15 – T1 return filing deadline

Corporation

A corporation may be a good option for YouTubers’ generating substantial income in excess of the income level required to sustain their lifestyle. A corporation offers unique tax-planning opportunities and advantages, not to mention the limited liability nature of this business entity. Oftentimes, individuals will start out in a sole proprietor structure, but transition into a corporate structure after seeing a certain level of success. Ensure you consult with a professional before making significant tax decisions.

Business income and expenses are treated similarly to sole proprietors for Canadian corporations. However, the general tax administrative requirements are generally more intensive, with tax slips required to be filed for dividend or employment income payments by February 28, and the required filing of a T2 corporate income tax return six-months after corporate year-end. An accountant will generally be required to handle the complexities of corporate tax, and thus, specific tax instructions are outside of the scope of this guide.

SEE ALSO: Setting Up YouTube Business Legal Structure

Deadlines

February 28 – any balances owing due to CRA (assuming a December 31 year-end)

February 28 – tax slips filing deadline (ie. T5 for dividends, T4 for employment income)

June 30 – T2 return filing deadline (assuming a December 31 year-end)

Instalment payments are due on the last day of every complete month of your tax year, or of every complete quarter if you are an eligible small Canadian-Controlled Private Corporation (CCPC).

Common Business Expenses and Deductions

Listed below are some common business expenses that a YouTuber may incur during the course of their business.

- Business use of home: if you film inside your home, have a dedicated studio space, and/or use your home as a workspace to edit and upload your videos, you can claim a portion of all of the expenses that contribute to maintaining your house – including property taxes, heat, electricity, insurance, maintenance, and mortgage interest

- Office expenses: any expenses incurred in the course of maintaining the business-side of your YouTube channel are deductible – including pens, printer paper, toner, and business bank account fees

- Internet: the costs you pay to your internet service provider (ISP) are deductible at the percentage used for your YouTube business (ie. 50%)

- Cell phone: your cell phone bill is also deductible at the percentage used for your YouTube business

- Professional fees: any fees associated with experts you’ve hired in the course of your YouTube business, either for consulting to help you get started or for a CPA you’ve hired to help with your taxes, are deductible

- Vehicle & mileage: costs associated with travel via automobile for business purposes are deductible to an extent

- Travel: other travel costs (hotel room, airfare, Uber, car rental) associated with YouTube conferences or other destinations directly relevant to your YouTube business may be deductible

- Data storage & subscriptions: purchases of external hard drives or cloud storage subscriptions are deductible when used for the purpose of storing video footage; additionally, any ongoing subscriptions relevant to your YouTube channel, such as royalty-free music licensing services, are deductible

- Advertising: costs associated with advertising your YouTube channel are deductible, other acceptable costs under this category may include the cost of contests and giveaway prizes

- Software: the purchase of professional video editing software used for YouTube may be completely deductible (may be a capital asset depreciable under CCA)

Capital Cost Allowance

Depreciable property such as a building, furniture, or equipment used in the course of your business cannot be fully deducted in the year in which they are purchased. Instead, the cost of these properties will be deducted over the course of several years at a rate determined by the Canada Revenue Agency, known as a Capital Cost Allowance (CCA) rate. Listed below are a few examples of CCA categories and rates for common purchases a YouTuber may make.

- Cameras and Video Recording Equipment: Class 8 (20%) costing $500 or more, otherwise Class 12 (100%)

- Photocopiers, Printers, Fax Machines, and Telephones: Class 8 (20%)

- Laptops, iPads: Class 50 (55%)

- Furniture: Class 8 (20%)

- Video Software, Accounting Software (ie. QuickBooks): Class 12 (100%)

- Passenger Vehicle: Class 10.1 (30%)

Sales Tax (GST/HST)

You do not need to register for GST/HST if you make under $30,000 gross when you are a sole proprietor over 4 consecutive calendar quarters. However, there can be some benefit in registering before this income milestone – referred to as “voluntary registration”. As a majority of your income will be derived from non-resident corporations, such as Google for Google AdSense, your “advertising services” provided to them are considered “zero-rated”. Thus, you are collecting sales tax effectively at a rate of 0%, but you are still able to claim any input tax credits (ITCs), meaning you are eligible to recover the GST/HST paid or payable on your purchases and operating expenses. Sales tax returns are required to be filed annually, quarterly, or monthly, depending on sales volume.

If you choose not to register, you do not charge the GST/HST (other than on certain taxable supplies of real property) and you cannot claim ITCs.

Canada Revenue Agency

Tax Withholding

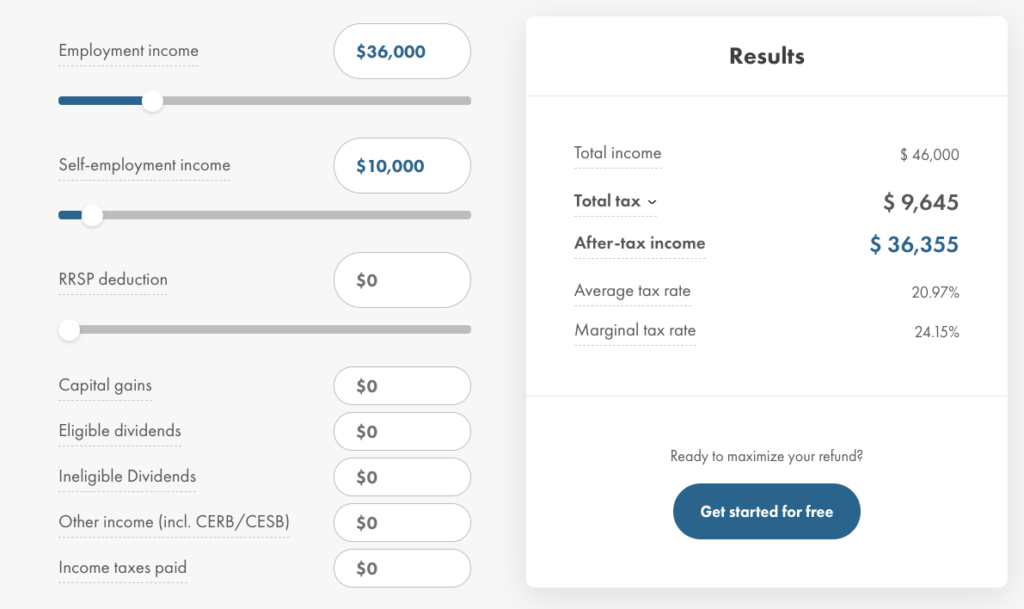

Google will not withhold taxes on AdSense earnings by a Canadian resident. Thus, it is your responsibility to ensure you appropriately manage your earnings and put away sufficient funds to pay your tax bill come April. You may estimate your future tax obligation and marginal tax rate through WealthSimple’s calculator. We recommend maintaining a separate bank account, perhaps a high-interest savings account, and putting away a percentage of your earnings based on your average tax rate, each time you’re paid.

YouTube Withholding Tax

Recently Google has announced that all creators in the YouTube Partner Program will be required to submit tax information by May 31, 2021, or may have their earnings reduced up to 24%.

Under U.S. tax law, Google is required to deduct taxes from your YouTube earnings from U.S. viewers, if applicable. The tax withholding requirements can differ depending on your country of residence, and whether you’re eligible to claim tax treaty benefits. Google will determine your withholding status based on the responses you provide in the form W8-BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

Since Canada has a tax treaty with the U.S., the tax withholding rate on royalty income is set at 0%. Therefore, once you provide your tax residency information and confirm to Google that you are a Canadian resident, Google will withhold taxes at a rate of 0% – in other words, Google will continue to not withhold any taxes on your earnings.