What is Form W-8BEN?

Form W-8BEN is an IRS tax form that is completed by NON U.S. Residents. This form is completed by residents of countries other than the United States of America. Google collects this information to certify that your country of residence for tax purposes is outside of the United States and ensures that your earnings are subject to the correct U.S. income tax withholding requirements pursuant to any relevant tax treaties between the United States and your country of residence.

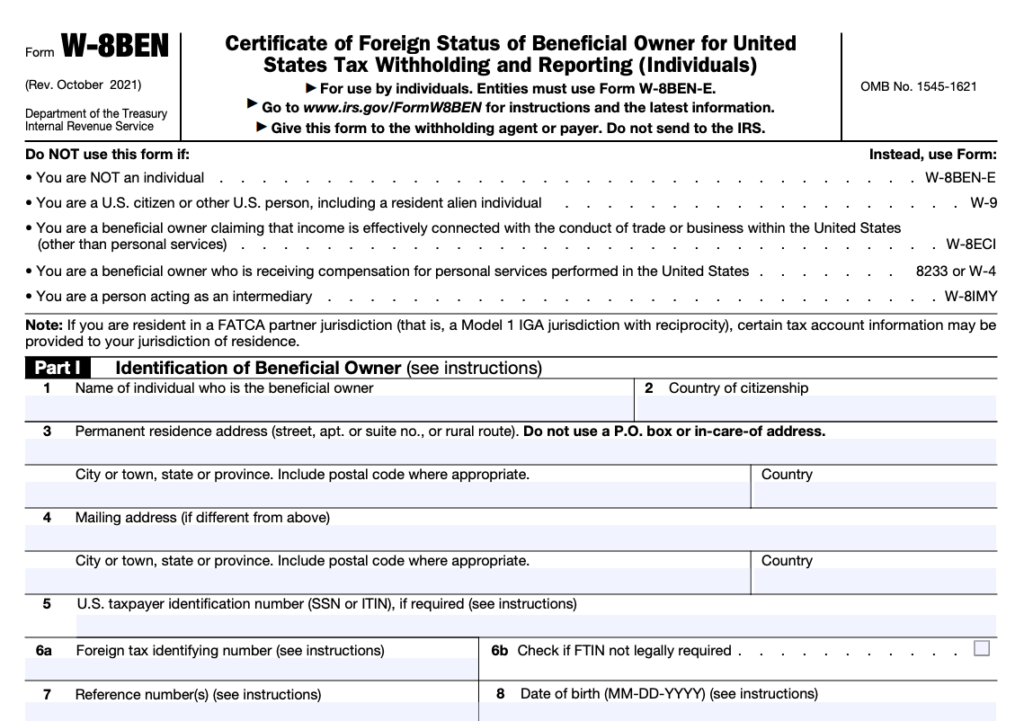

What Information is Provided on Form W-8BEN?

Form W-8BEN collects essential information necessary for a payer entity (Google) to ensure foreign individuals are subject to the correct U.S. income tax withholding requirements.

- Name

- Address

- Date of birth

- Taxpayer identification number in country of residence

- Country of residence for income tax purposes

How to Complete Form W-8BEN For Google AdSense

All monetizing creators on YouTube, regardless of their location in the world, are required to provide tax info.

Follow the instructions below to submit your U.S. tax info to Google:

- Sign in to your AdSense account.

- Click Payments.

- Click Manage settings.

- Scroll to “Payments profile” and click edit Edit next to “United States tax info“.

- Click Manage tax info.

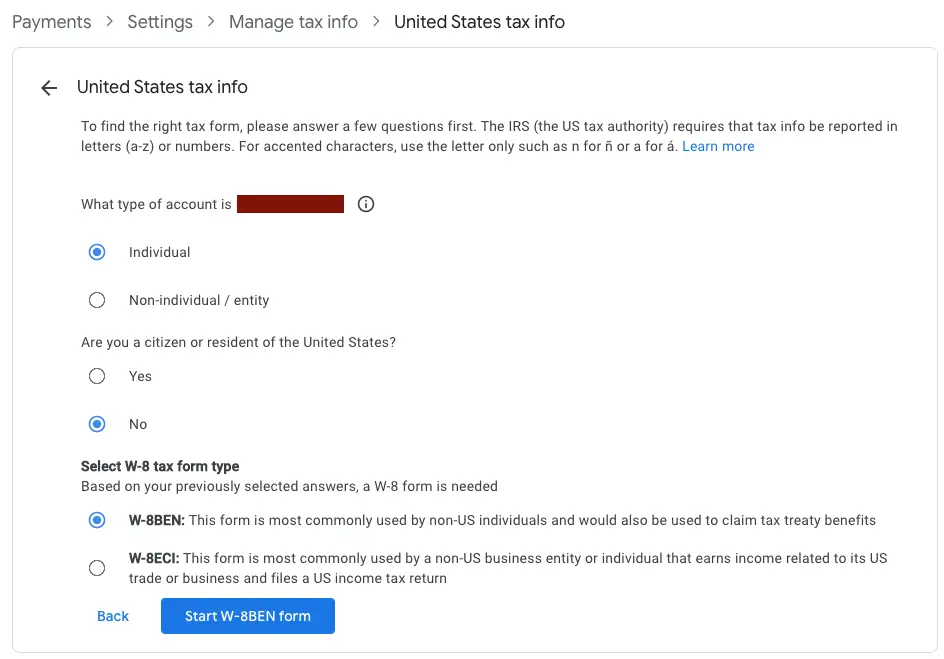

United States tax info: fill this screen out as appropriate, typically the form W-8BEN is completed by an individual who is not a citizen or resident of the United States.

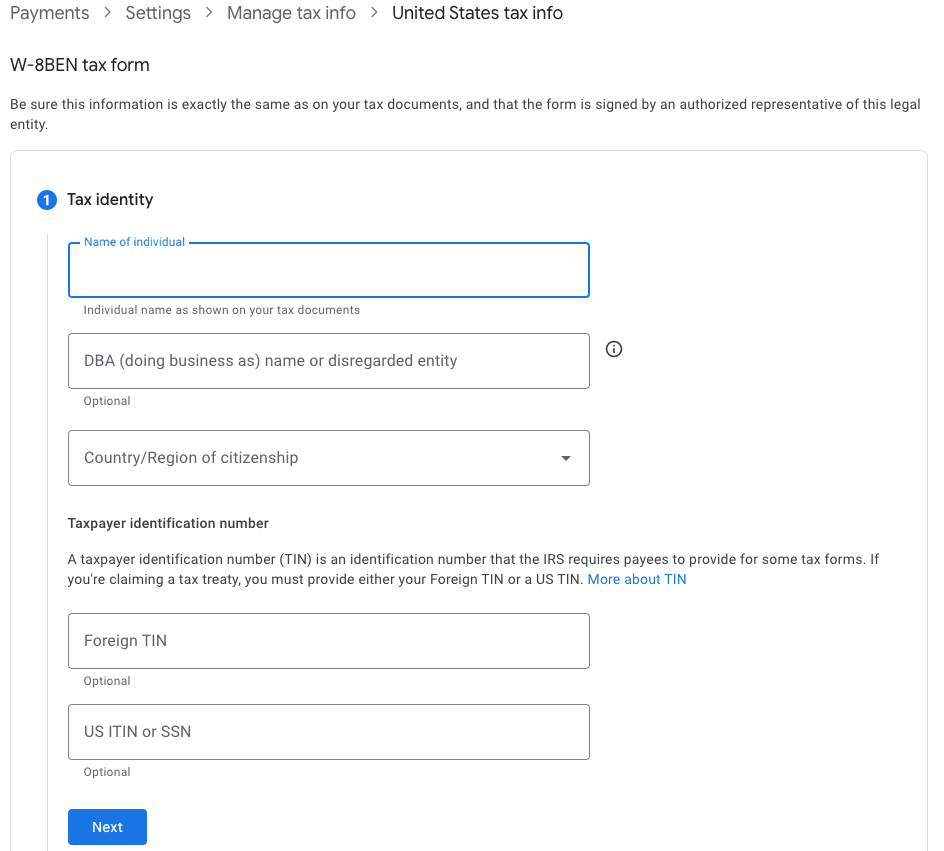

Tax identity: provide your full legal name, country of citizenship, and your tax identification number in your country of residence (Foreign TIN – example: social insurance number in Canada (SIN))

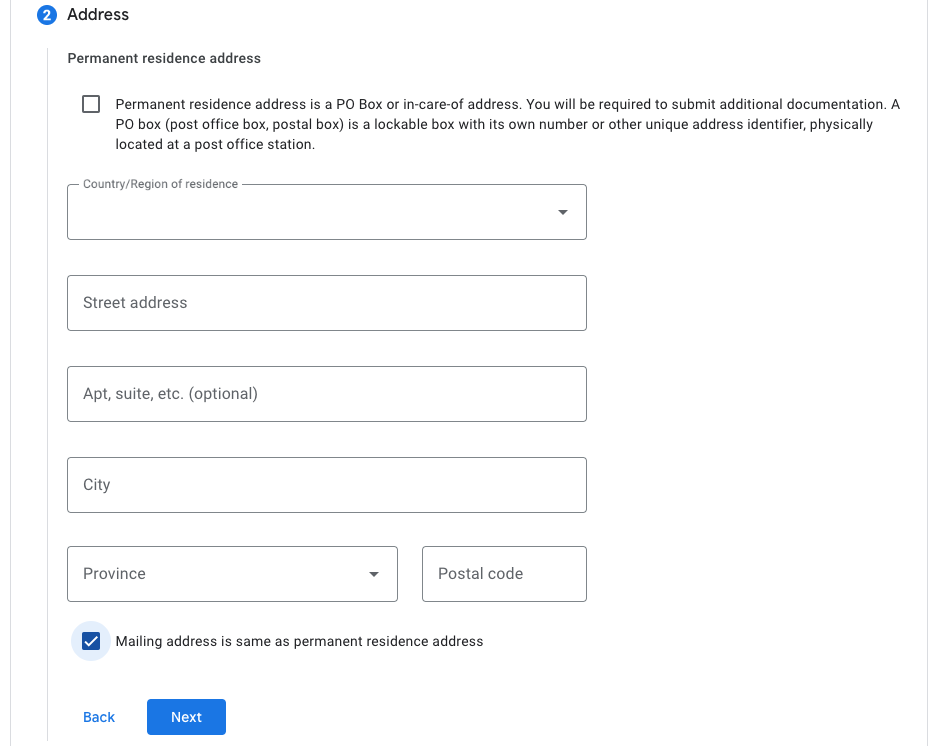

Address: provide your address of permanent residence and your mailing address (if different)

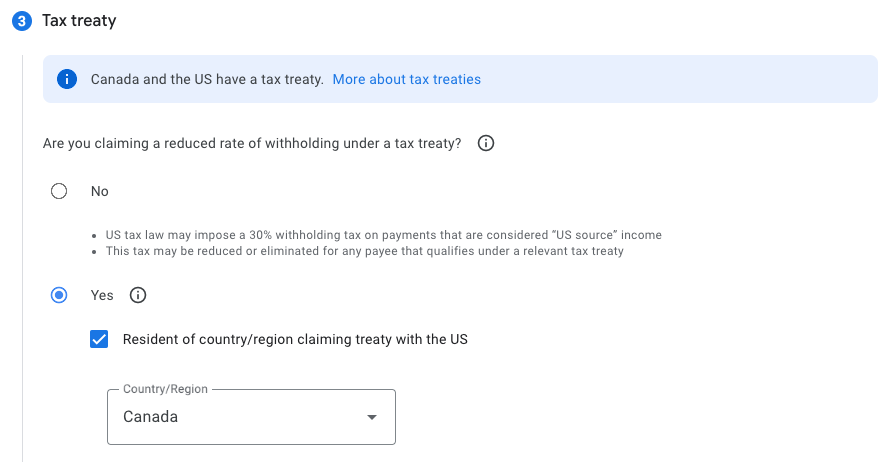

Tax treaty: if you reside in a country which has a tax treaty with the United States, select “Yes” and provide the name of your country of tax residence

Special rates and conditions: select the “Services” box and select the appropriate article, paragraph, and withholding rate from the dropdown boxes provided. Ensure that tax conditions to access this reduced withholding rate are met and select the checkbox as appropriate.

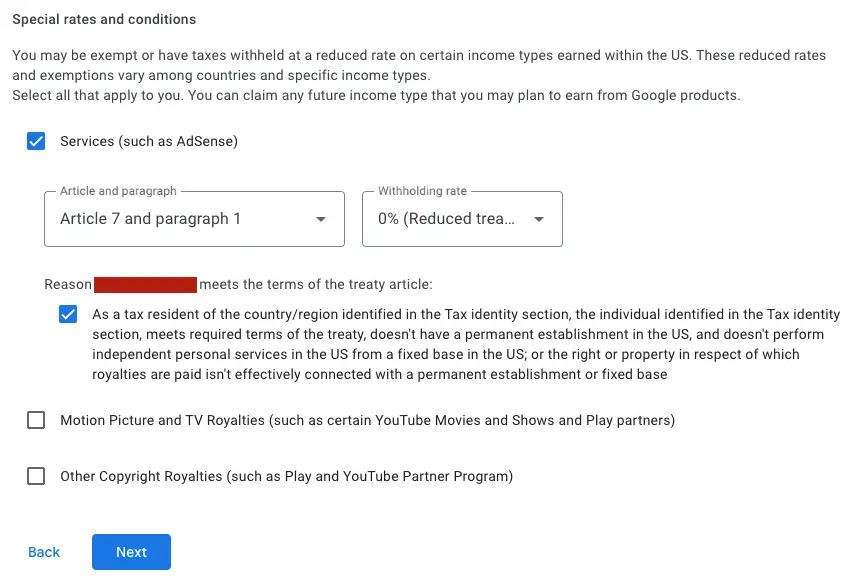

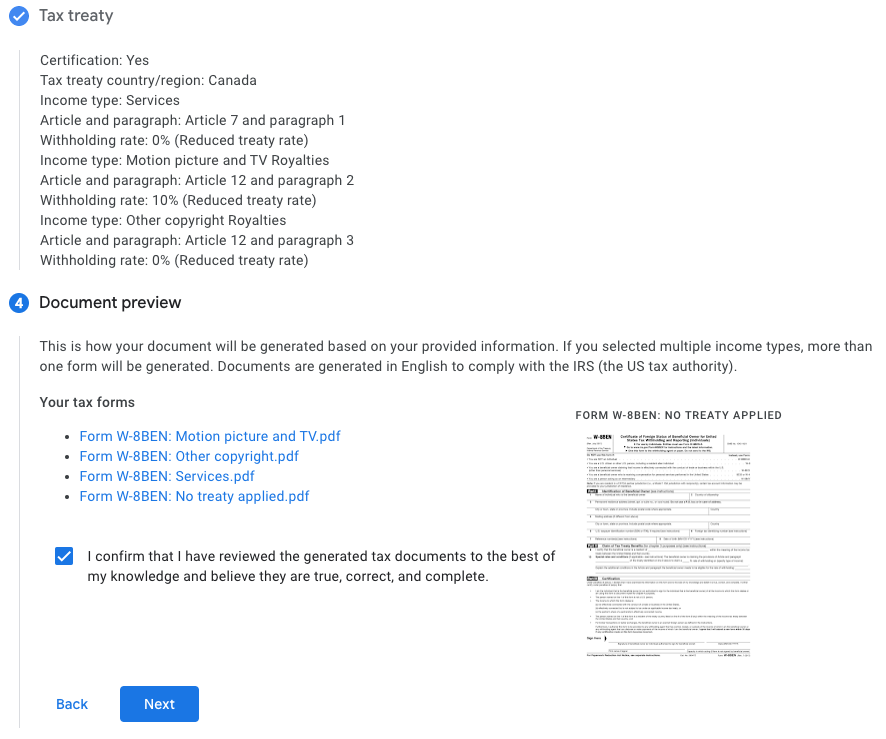

Document preview: ensure that the tax treaty selections are appropriate and then preview the PDF files created by Google to ensure that all of your information has been inputted correctly. Once done, select the confirmation checkbox.

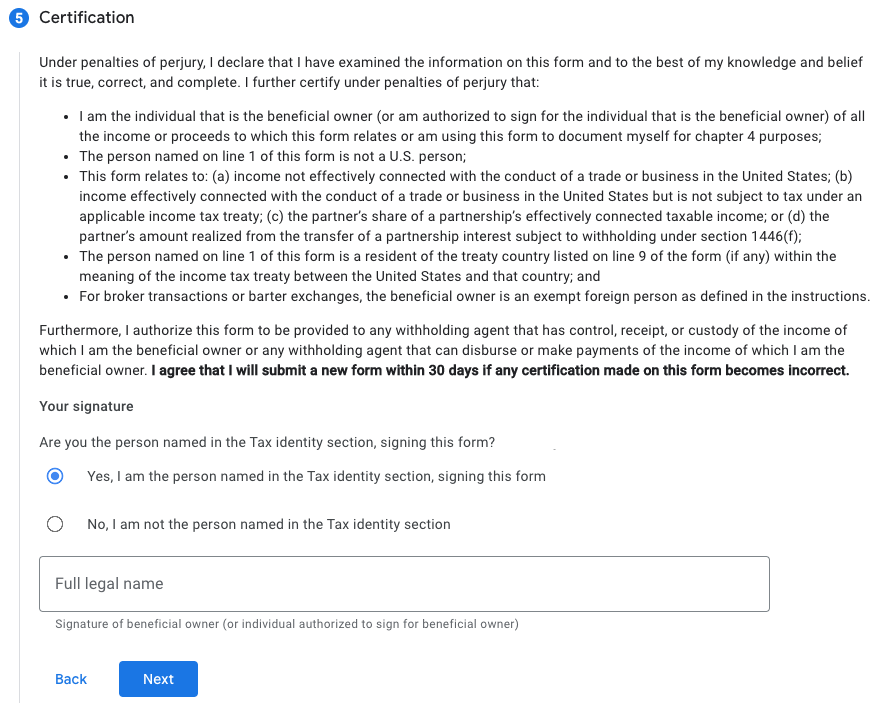

Certification: type your full legal name in this section to legally certify that the information provided is correct.

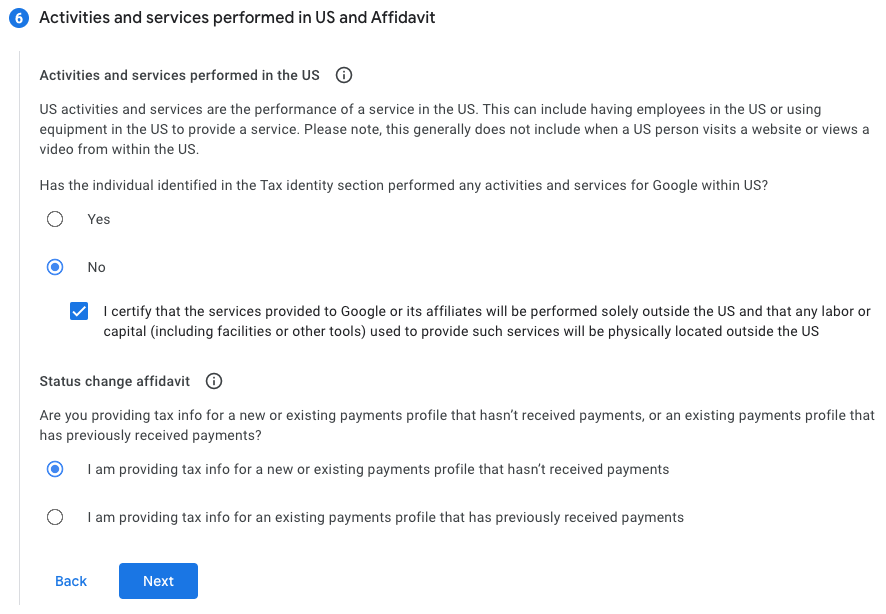

Activities and services performed in U.S. and Affidavit: certify that all activities and services performed for Google (ie. AdSense advertising) are NOT performed within the United States. Select the appropriate selection whether you have already received payment from AdSense or not.

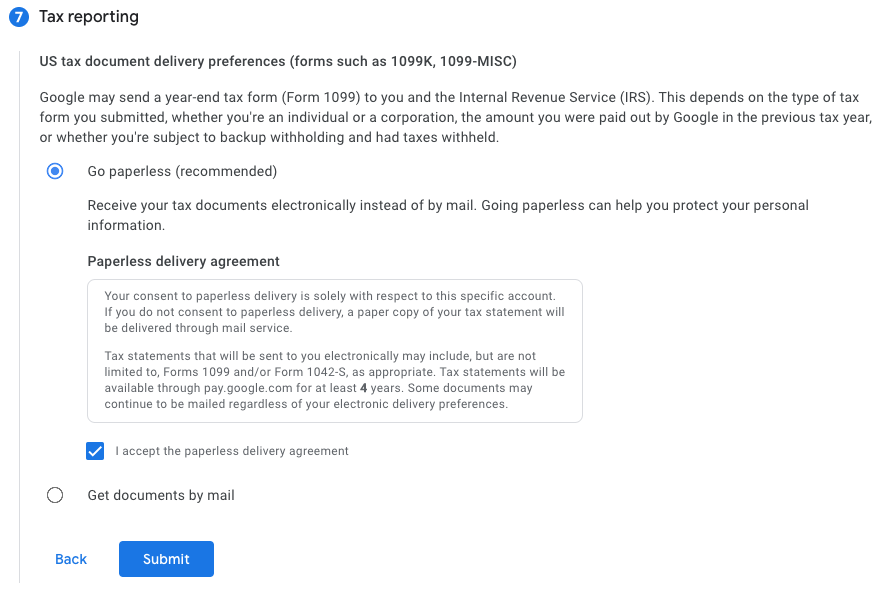

Tax reporting: select whether you’d like to go paperless for tax documents delivery or whether you prefer physical mail.

Once done, Submit the form.