So you’ve signed up as an Fansly creator, and now you’re being asked to fill out something called Form W-9. We’re here to explain it for you and help you accurately complete and submit this tax form.

Contents

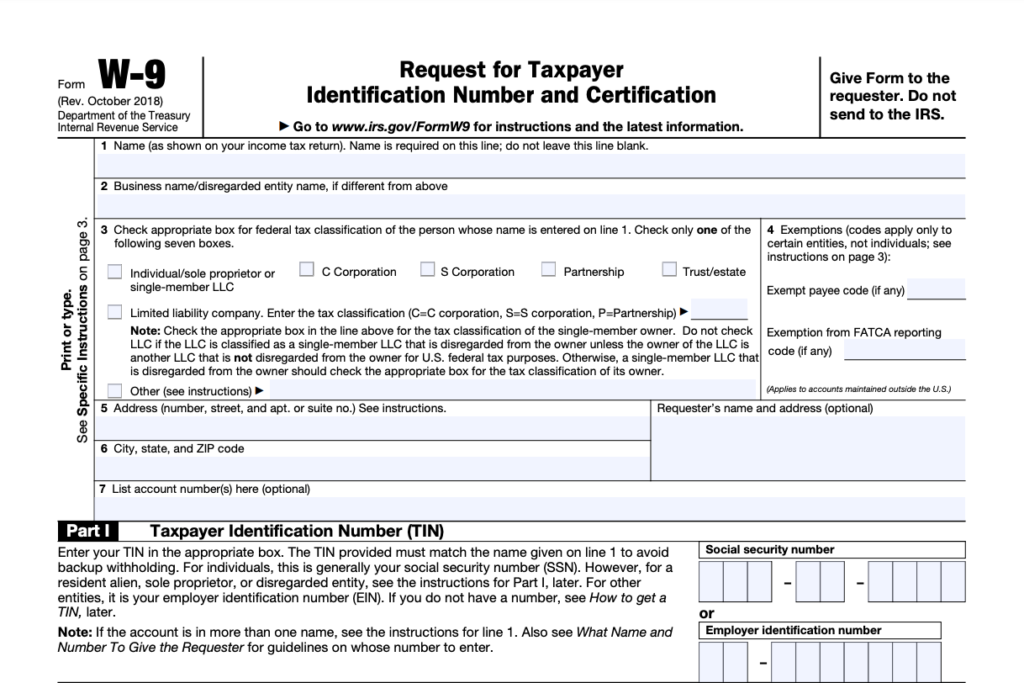

What is Form W-9?

Form W-9 is an IRS tax form that is requested by entities who must prepare and file any combination of US tax information returns with the IRS. Form W-9 is similar to a questionnaire and provides the entity (ie. Fansly) with sufficient information to prepare tax forms for the freelancer or contractor (you!).

What Information is Provided on Form W-9?

Form W-9 collects essential information necessary for a payer entity to prepare correct tax forms for contractors, including:

- Name

- Business name (if applicable)

- Address

- Taxpayer identification number (TIN)

- Tax classification of contractor

- Any tax exemptions applicable

How to Complete Form W-9 For Fansly

When you become a creator on Fansly, you will need to complete Form W-9, which provides Fansly the information necessary to pay you and provide tax documents at the end of the year (ie. Form 1099-K). As a sole proprietor, you would fill this form out as yourself in your personal capacity. You will not receive a Form W-2 as a Fansly creator, as you are deemed to be a contractor and not an employee for tax purposes.

You can submit your Form W-9 by navigating to your Creator Dashboard, expand the list by clicking More, then select Tax Documentation.

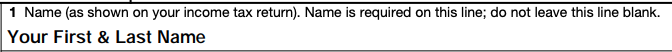

Box 1: Name – this would be your first and last name on file with the IRS

Box 2: Business name – this would be left blank in most cases for sole proprietors

For your Fansly W9, business name is left blank for most people.

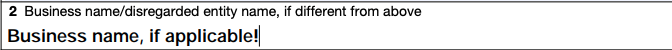

Box 3: Federal tax classification – you would check off the first option, “Individual/sole proprietor or single-member LLC”

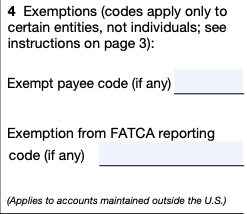

Box 4: Tax exemptions – leave this blank

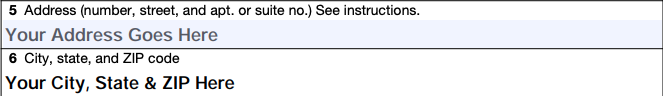

Box 5 & 6: Address – complete this with your address

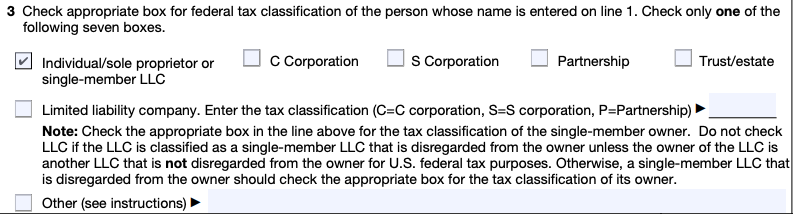

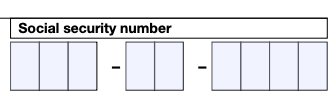

Part I: Taxpayer Identification Number (TIN) – your social security number (SSN) will serve as your identification number – you do not need to obtain an employer identification number (EIN) as a sole proprietor

Part II: Certification – read and agree to the certification and attach your e-signature once done

Scroll all the way down and click “Send“.

How do OnlyFans creators pay taxes? See our U.S. Tax Guide

Frequently Asked Questions

Do Fansly creators have to pay taxes?

Yes, Fansly creators have to pay taxes on all income associated with being a creator. Income attributable to an Fansly business may include subscription revenues, pay-per-view sales, and tips.

Does Fansly provide W2s?

No, Fansly does not provide W2s. Your earnings on Fansly are considered business income. Fansly is not considered your employer and is therefore not required to provide you a W2 form.

Fansly will provide you with a 1099-K if they’ve paid you over $20,000 in the calendar year. They will email this form in the month of January following the completion of the prior calendar year. Ensure that you save this tax form for tax preparation as the IRS will also have a copy and will expect you to report this income on your tax return!

Is being a Fansly creator considered a business?

Yes, being a Fansly creator is considered a business venture. As a Fansly creator, you are deemed to be carrying on a business in the eyes of the Internal Revenue Service (IRS). Therefore, you must report all earnings associated with your Fansly business as gross business income. You are then entitled to various deductions to bring down your overall net income for business purposes.

Most creators are deemed to be a sole proprietor unless they otherwise incorporate or set up a different legal structure for their business. As a sole proprietor, you would generally be deemed to earn self-employment income. Self-employment income is taxed under U.S. tax law similar to employment income. However, a sole proprietor may claim deductions for business expenses, generally not available to employees.

Can I write-off expenses against my Fansly income?

Yes, you are also entitled to take deductions against your Fansly income, to reduce the overall amount of taxes that you’d need to pay. Learn more: Common Tax Write-Offs for OnlyFans Creators

Will the 1099-K that Fansly sends me, say “Fansly” anywhere on it?

No, the 1099-K will be issued by a company called “Select Media LLC”.

Do I need an EIN for Fansly?

No, you don’t need an EIN (employer identification number) for Fansly. You can simply use your SSN (social security number) as your tax identifier.

Do I need a model release form when I collaborate on Fansly?

Yes, if you feature other creators in your Fansly videos or images, you will need to obtain a signed model release form before posting that content. Learn more: How To Get OnlyFans Model Release Form

Does Fansly withhold taxes from payments?

No. Fansly does not withhold any taxes from your funds earned on the platform.