This is the Canadian income tax guide for influencers and creators earning income.

Disclosure: This is not official tax advice. Always perform your own research and consult with a CPA/tax expert.

Contents

Do influencers have to pay taxes?

Yes. Influencers have to pay taxes on all income associated with being an influencer. Income attributable to an influencer business may include sponsorship income, merchandise sales, affiliate sales, paid product reviews, and/or ad revenue.

Are free products received considered income?

Yes. If you receive free products to promote on your social media channels, this is considered income for tax purposes. Even though you have not received any cash, you have still received an income inflow and must declare the fair market value of the goods as income. The fair market value is often the price you would have had to pay for the products had you not received them for free.

Is being an influencer considered a business?

Yes. As an influencer making income from your own brand or notoriety, you are deemed to be carrying on a business in the eyes of the Canada Revenue Agency (CRA). Therefore, you must report all earnings associated with your influencer business as gross business income. You are then entitled to various deductions to bring down your overall net income for business purposes.

Types of Business Entities

Sole Proprietorship

A sole proprietorship is an unincorporated business that is owned by one individual. It is the simplest kind of business structure.

Canada Revenue Agency

If you are a sole proprietor, you pay personal income tax on the net income generated by your business.

You may choose to register a business name or operate under your own name or both.

A common question that we get asked is “Are influencers sole proprietors?”. In most circumstances, the answer is yes, influencers are sole proprietors. By default, people who make money from social media will be considered a sole proprietor and will be required to report their social media-derived income as business income.

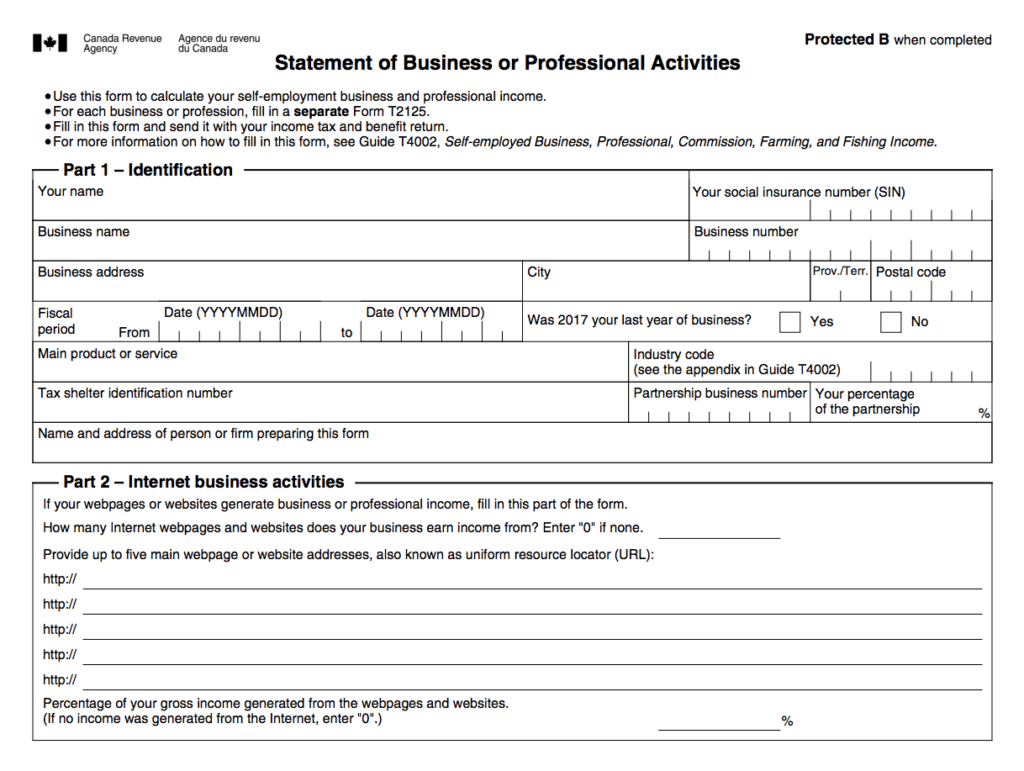

A sole proprietorship is the most common form of business entity for independent influencers and creators. As a sole proprietor, your influencer income is reported on your personal income tax return (T1) under form T2125 “Statement of Business or Professional Activities”.

Completing Form T2125

Identification

You may simply use your name as the business name. The NAICS (North American Industry Classification System) code 519130 “Internet Publishing and Broadcasting and Web Search Portals” should serve as an appropriate industry code for influencers.

Internet Business Activities

On form T2125, you must list all appropriate websites from which your income is derived. As an influencer, some of the most common may be Instagram.com, and Facebook.com, however, any additional income streams associated with this business must also be disclosed, which may include Shopify.com or Amazon.com, if these are platforms from which you derive additional income.

Reporting Business Income

The next parts of the form require you to report your gross income received through your business. If you get paid in USD, you must convert the USD amounts using the annual average exchange rate retrieved from the Bank of Canada. Additionally, any goods received through the course of your influencer business also need to be declared as income at their fair market value, so don’t forget about that makeup kit you received in exchange for a brand shoutout on your channel or social media accounts.

Neo Financial: Our Recommendation

Open a Neo Money account and earn up to 225x more interest than at traditional banks (2.25% APY), all with no annual or monthly fees (FREE)! Neo Financial is a 100% digital banking service and it only takes 3 minutes to setup your account.

Apply for the Neo Card and receive a $25 welcome bonus while earning an average of 5%+ cashback at thousands of local and national partners and businesses. The Neo Card will allow you to keep your business expenses separate, all while earning instant cashback on purchases and no annual fees.

Neo Money is provided by Concentra Bank.

Card issued by ATB Financial pursuant to license by Mastercard International Inc.

Claiming Business Expenses

As a business, you are entitled to deduct expenses that you may incur to earn income from your activities. For common business expenses as an influencer, please see the Common Business Expenses and Deductions section below. Depreciable property such as a building, furniture, or equipment used in the course of your business cannot be fully deducted in the year in which they are purchased. Instead, the cost of these properties will be deducted over the course of several years at a rate determined by the Canada Revenue Agency, known as a Capital Cost Allowance (CCA) rate. Typical CCA rate categories are listed under the Capital Cost Allowance section below.

Common Business Expenses and Deductions

Listed below are some common business expenses that an influencer may incur during the course of their business.

- Business use of home: if you film inside your home, have a dedicated studio space, and/or use your home as a workspace to edit and upload your content/videos, you can claim a portion of all of the expenses that contribute to maintaining your house – including property taxes, heat, electricity, insurance, maintenance, and mortgage interest

- Office expenses: any expenses incurred in the course of maintaining the business-side of your influencer social media channels are deductible – including pens, printer paper, toner, and business bank account fees

- Internet: the costs you pay to your internet service provider (ISP) are deductible at the percentage used for your influencer business (ie. 50%)

- Cell phone: your cell phone bill is also deductible at the percentage used for your influencer business

- Professional fees: any fees associated with experts you’ve hired in the course of your influencer business, for example, the costs associated with a CPA you’ve hired to help with your taxes, are deductible

- Vehicle & mileage: costs associated with travel via automobile for business purposes are deductible to an extent

- Travel: other travel costs (hotel room, airfare, Uber, car rental) associated with influencer conferences or other destinations directly relevant to your influencer business may be deductible

- Data storage & subscriptions: purchases of external hard drives or cloud storage subscriptions are deductible when used for the purpose of storing video footage; additionally, any ongoing subscriptions relevant to your influencer channels, such as royalty-free music licensing services, are deductible

- Advertising: costs associated with advertising your influencer channels are deductible, other acceptable costs under this category may include the cost of contests and giveaway prizes

- Software: the purchase of professional video editing software used for your content may be completely deductible (may be a capital asset depreciable under CCA)

Capital Cost Allowance

Depreciable property such as a building, furniture, or equipment used in the course of your business cannot be fully deducted in the year in which they are purchased. Instead, the cost of these properties will be deducted over the course of several years at a rate determined by the Canada Revenue Agency, known as a Capital Cost Allowance (CCA) rate. Listed below are a few examples of CCA categories and rates for common purchases an influencer may make.

- Cameras and Video Recording Equipment: Class 8 (20%) costing $500 or more, otherwise Class 12 (100%)

- Photocopiers and Printers: Class 8 (20%)

- Laptops, iPads, iPhone: Class 50 (55%)

- Furniture: Class 8 (20%)

- Video Software, Accounting Software (ie. QuickBooks): Class 12 (100%)

- Passenger Vehicle: Class 10.1 (30%)

Tax Deadlines

April 30 – any balances owing due to CRA

June 15 – T1 return filing deadline

Sales Tax (GST/HST)

You do not need to register for GST/HST if you make under $30,000 gross when you are a sole proprietor over 4 consecutive calendar quarters. However, there can be some benefit in registering before this income milestone – referred to as “voluntary registration”. If a majority of your income will be derived from non-resident corporations, such as U.S. corporations, your income/sales to them is considered “zero-rated”. Thus, you are collecting sales tax effectively at a rate of 0%, but you are still able to claim any input tax credits (ITCs), meaning you are eligible to recover the GST/HST paid or payable on your purchases and operating expenses. Sales tax returns are required to be filed annually, quarterly, or monthly, depending on sales volume.

If you choose not to register, you do not charge the GST/HST (other than on certain taxable supplies of real property) and you cannot claim ITCs.

Canada Revenue Agency

Tax Withholding

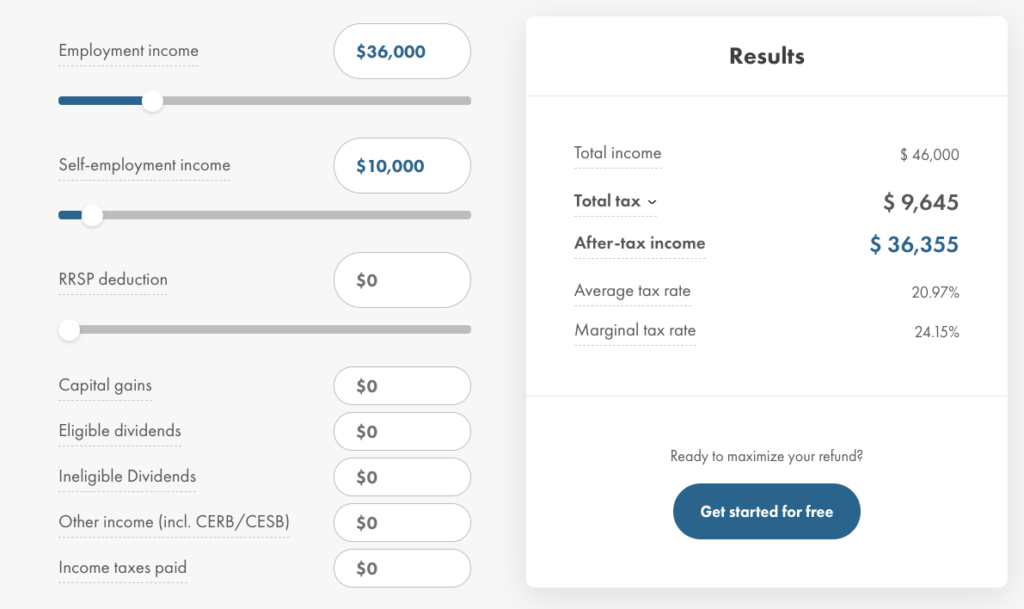

Companies will not withhold taxes on earnings by a Canadian resident. Thus, it is your responsibility to ensure you appropriately manage your earnings and put away sufficient funds to pay your tax bill come April. You may estimate your future tax obligation and marginal tax rate through WealthSimple’s calculator. We recommend maintaining a separate bank account, perhaps a high-interest savings account, and putting away a percentage of your earnings based on your average tax rate, each time you’re paid.

Tax Best Practices

- Find a reputable tax accountant and work with them throughout the year to ensure you meet your filing obligations and are prepared come tax season. We recommend Virtual Books, a Canadian accounting and tax provider specializing in influencers and creators.

- Use an accounting software or find a bookkeeper (virtual bookkeepers are becoming more common) to help you keep your finances in order all year long. This reduces the burden of needing to compile and calculate all of your expenses during tax season.

- Open a separate bank account where income payments are deposited and funds for expenses will be drawn from. This ensures a hard line is drawn between personal and business activities and increases the odds of a favorable audit.

- Similarly, use a separate credit card for business purchases only to ensure clean recordkeeping.

- Take advantage of technology – use your phone to scan and create copies of all expense documentation.