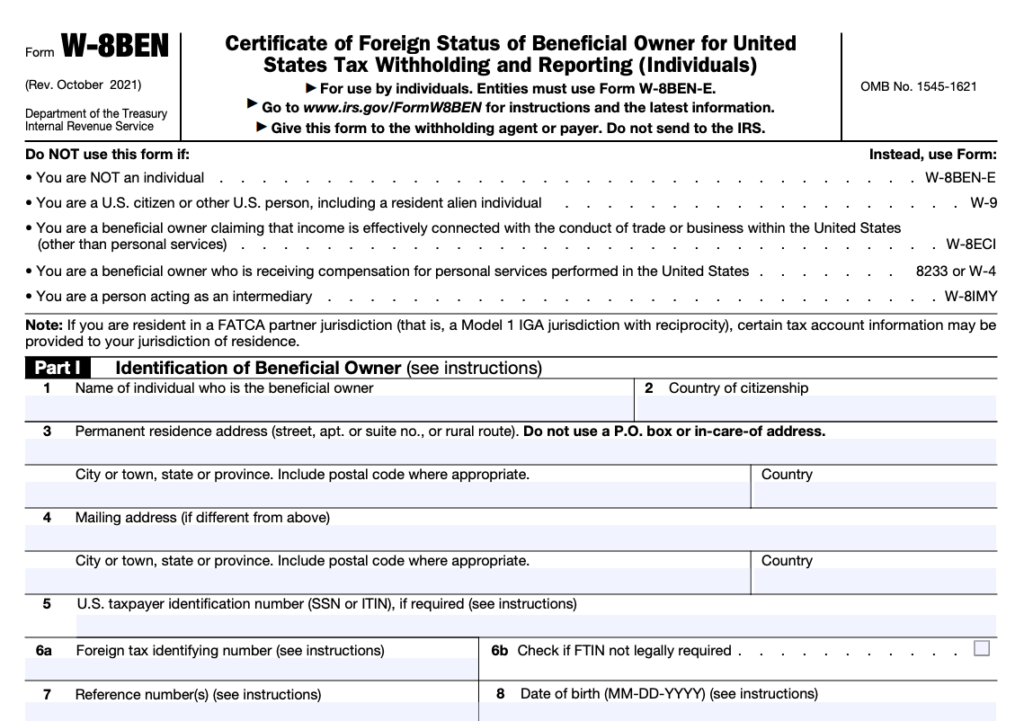

What is Form W-8BEN?

Form W-8BEN is an IRS tax form that is completed by NON U.S. Resident Fansly creators. This form is completed by residents of countries other than the United States of America. Fansly collects this information to certify that your country of residence for tax purposes is outside of the United States and ensures that none of your earnings are subject to U.S. income tax withholding requirements.

What Information is Provided on Form W-8BEN?

Form W-8BEN collects essential information necessary for a payer entity (Fansly) to exempt foreign creators from U.S. income tax withholding requirements.

- Name

- Address

- Date of birth

- Taxpayer identification number in country of residence

- Country of residence for income tax purposes

How to Complete Form W-8BEN For Fansly

As a non-U.S. resident creator on Fansly, you will need to complete Form W-8BEN, which exempts foreign creators from U.S. income tax withholding requirements.

You can submit your W-8BEN by navigating to your Creator Dashboard, expand the list by clicking More, then select Tax Documentation.

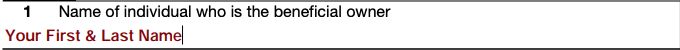

Box 1: Name – this would be your legal first and last name

Box 2: Country of citizenship – this would be the name of the country which you are a citizen of – note that this may not be the same country which you are a tax resident of!

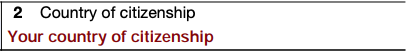

Box 3: Address – complete this with your permanent residence address

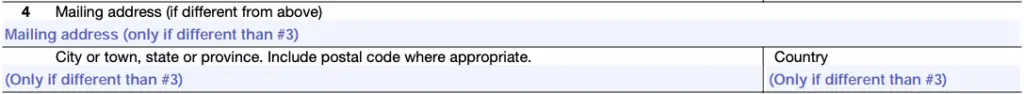

Box 4: Mailing address – complete this only if your mailing address is different than your permanent residence address in Box 3

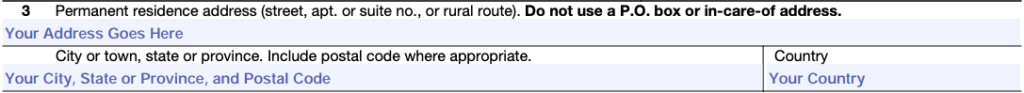

Box 5: U.S. SSN or ITIN – leave this blank

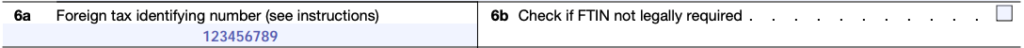

Box 6a/6b: Foreign tax identifying number (FTIN) – if you have a tax number from your country of residence (ie. social insurance number – SIN), enter it here. If your country of residence does not issue tax numbers, check the box in 6b.

Box 7: Reference number – leave this blank

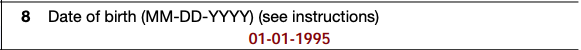

Box 8: Date of birth – input your date of birth

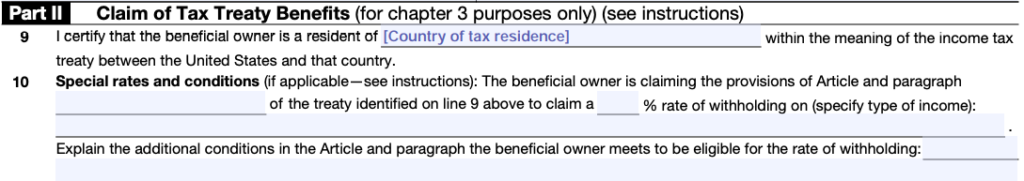

Part II: Claim of Tax Treaty Benefits – input your country of tax residence in Box 9 and leave Box 10 blank

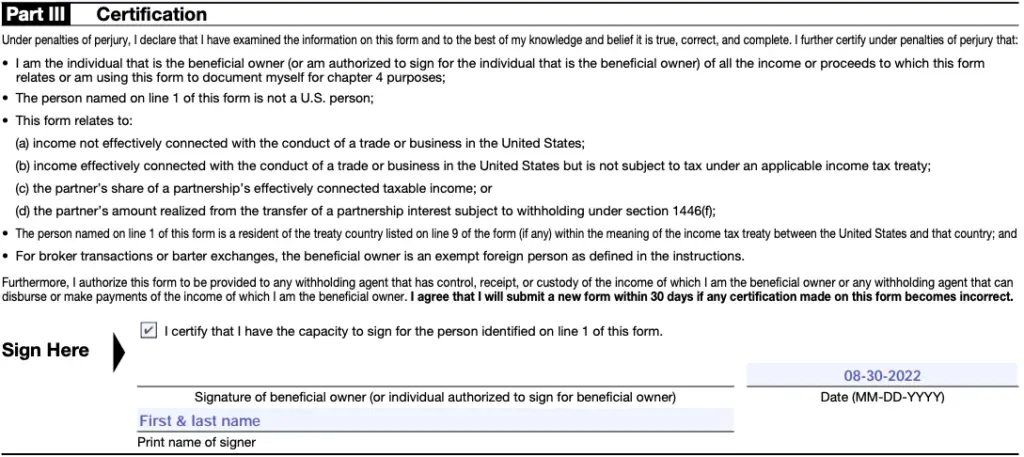

Part III: Certification – read and agree to the certification and attach your e-signature once done

And you’re done! Submit the form and continue creating!

How do OnlyFans creators pay taxes? See our Canadian Tax Guide