So you’ve signed up to make money as a TikTok creator, and now you’re being asked to fill out something called Form W-9. You’re an influencer, not a tax accountant – well have no fear, we’re here to break it all down for you!

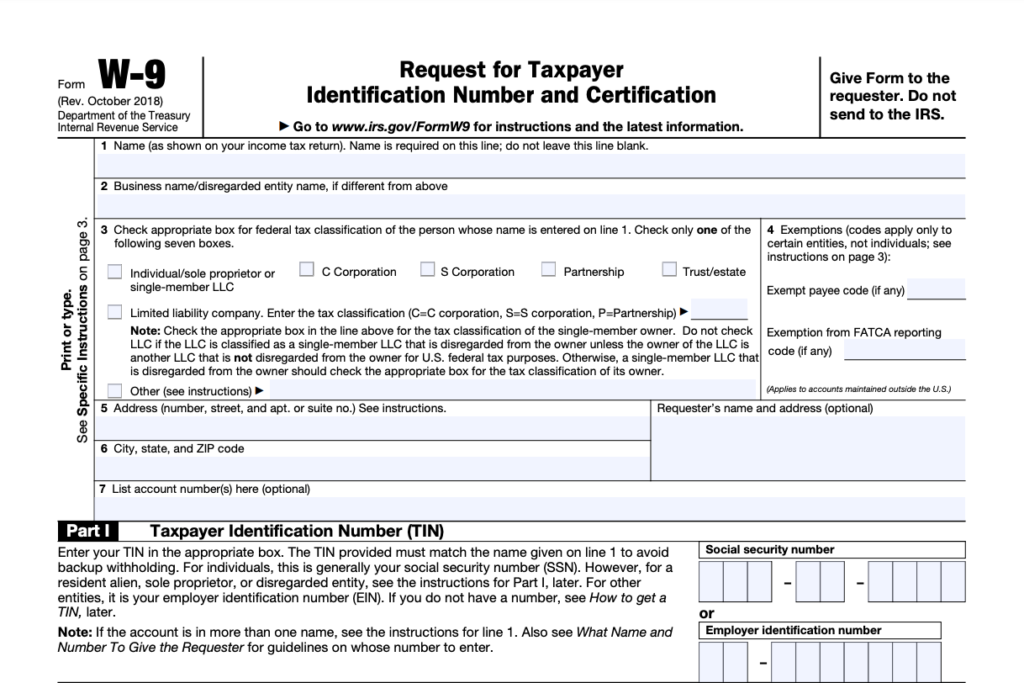

What is Form W-9?

Form W-9 is an IRS tax form that is requested by entities who must prepare and file any combination of US tax information returns with the IRS. Form W-9 is similar to a questionnaire and provides the entity (ie. TikTok) with sufficient information to prepare tax forms for the freelancer or contractor (you!).

What Information is Provided on Form W-9?

Form W-9 collects essential information necessary for a payer entity to prepare correct tax forms for contractors, including:

- Name

- Business name (if applicable)

- Address

- Taxpayer identification number (TIN)

- Tax classification of contractor

- Any tax exemptions applicable

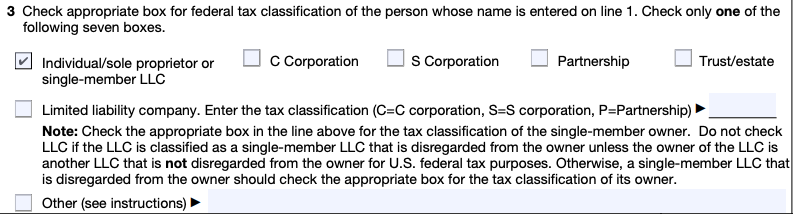

How to Complete Form W-9 For TikTok

When you become a paid creator on TikTok (through the TikTok Creator Fund or other creator programs), you will need to complete Form W-9, which provides TikTok the information necessary to pay you and provide tax documents at year end (ie. Form 1099-MISC). As a sole proprietor, you would fill this form out as yourself in your personal capacity. You will not receive a Form W-2 as a TikTok creator, as you are deemed to be a contractor and not an employee for tax purposes.

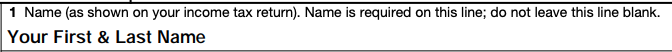

Box 1: Name – this would be your first and last name on file with the IRS

Box 2: Business name – this would be left blank in most cases for sole proprietors

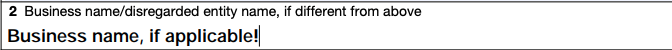

Box 3: Federal tax classification – you would check off the first option, “Individual/sole proprietor or single-member LLC”

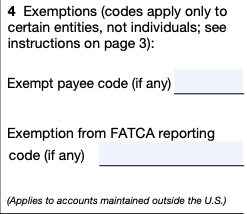

Box 4: Tax exemptions – leave this blank

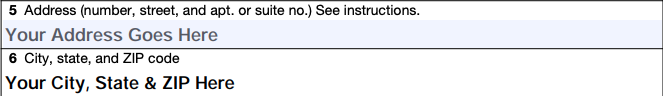

Box 5 & 6: Address – complete this with your address

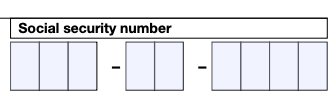

Part I: Taxpayer Identification Number (TIN) – your social security number (SSN) will serve as your identification number – you do not need to obtain an employer identification number (EIN) as a sole proprietor

Part II: Certification – read and agree to the certification and attach your e-signature once done

Scroll all the way down and click “Send”.

How do TikTok creators pay taxes? See our U.S. Tax Guide